Amazon is reportedly planning to drop the USPS and build a rival delivery network.

Morgan Stanley predicts AI shopping agents will add $115 billion to ecommerce by 2030.

Shopify's Black Friday triumph was marred by a critical Cyber Monday outage.

Source: Retail TouchPoints

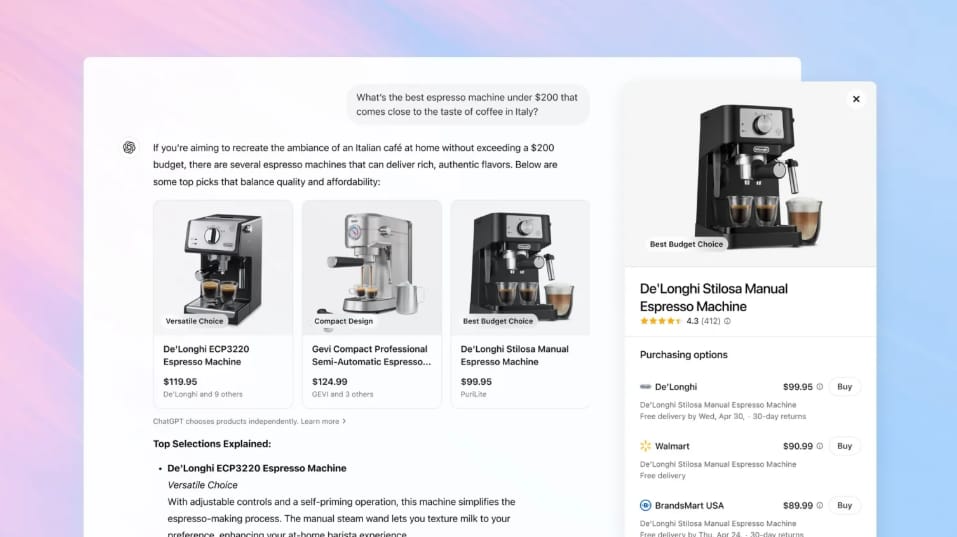

ChatGPT Traffic to Retailers Spiked 28%

While we talk about "AI agents" as the future, the shift is already happening. Referrals from ChatGPT to retailer mobile apps jumped 28% year-over-year during Black Friday. Shoppers aren't just searching Google anymore; they're asking their chatbots where to buy. → via TechCrunch

BNPL Breaks the $1B Barrier on Cyber Monday 2025

U.S. shoppers used buy now, pay later (BNPL) for more than $1 billion in online purchases on Cyber Monday 2025 — the first time BNPL has crossed that mark, according to Adobe. → via Digital Commerce 360

Morgan Stanley: AI Agents Will Add $115 Billion to Ecommerce

Morgan Stanley forecasts that by 2030, nearly half of all online shoppers will use "AI agents" to make purchases. This shift to "agentic commerce" is expected to add $115 billion to the U.S. ecommerce market, fundamentally reshaping retail funnels. → via Business Insider

Shopify Outage Disrupts Cyber Monday for Thousands

On the biggest shopping day of the year, Shopify suffered a critical outage that locked merchants out of admin dashboards and disrupted point-of-sale systems. The failure underscores the fragility of centralized platforms, even as merchants processed record volumes. → via Tech Times

Estée Lauder Taps Shopify for Global Overhaul

Legacy beauty giant Estée Lauder has partnered with Shopify to completely overhaul its global ecommerce infrastructure. The move highlights the enterprise shift toward headless, scalable commerce platforms as the company targets $2.23 billion in online sales. → via Digital Commerce 360

Source: Tech Crunch

Amazon Reportedly Weighs Dropping USPS to Build Rival Service

In a potential bombshell for logistics, reports indicate Amazon is considering terminating its contract with the U.S. Postal Service—a partnership that generates roughly 7.5% of USPS revenue. Amazon is reportedly exploring the creation of its own competing nationwide delivery network to own the entire chain. → via TechCrunch

Amazon Cuts Fees for European Sellers in 2026

Responding to competitive pressure, Amazon announced it will reduce selling fees for European merchants by an average of £0.15/€0.17 per unit starting in 2026. The cuts specifically target referral fees in key categories like clothing and home products. → via EcommerceBytes

Amazon's Holiday Shift: Less Grocery, More Electronics

During the peak "Turkey Five" shopping period, Amazon's category mix shifted noticeably. The share of grocery orders dipped from 35% to 32%, while electronics and apparel saw gains. This confirms that during the deal-heavy holiday season, consumers view Amazon primarily as a destination for gifts and gadgets, not just daily essentials. → via CIRP

New AI Tool 'Brand Name Evaluator' Launches for Sellers

Amazon has rolled out a "Brand Name Evaluator," an AI tool designed to help sellers vet potential brand names before registration. The tool assesses trademark viability and customer appeal, potentially saving sellers significant time and legal costs. → via Seller Central

Source: Kohl’s

Kohl’s Ecommerce Grows 2x Faster Than Total Sales

While Kohl's total net sales dipped 2.8% in Q3, its digital business is a bright spot, growing 2.4% year-over-year. The divergence highlights the continued shift in consumer preference toward online channels, even for traditional department store shoppers. → via Digital Commerce 360

TikTok Shop Sheds 'Bargain' Image as Disney Joins

TikTok Shop is maturing rapidly. Major brands like Samsung, Ralph Lauren, and Disney have officially joined the platform, signaling a move away from the "bargain bin" reputation. As a result, average prices are climbing—footwear prices alone have risen 103% since April. → via Business Insider & Modern Retail

Walmart Advertising Revenue Grows 6x Faster Than Retail Sales

Walmart's ad business is exploding. Walmart Connect grew 33% in Q3, six times faster than the company's retail sales growth of 5%. This shift mirrors Amazon's trajectory, suggesting that paying for visibility on Walmart is rapidly becoming a requirement, not an option. → via Marketplace Pulse

Source: ABC News

Walmart Launches Drone Delivery in Atlanta

Walmart has expanded its drone delivery pilot to six stores in the Atlanta area. Following a successful rollout in Dallas, the move signals Walmart's commitment to owning the skies for ultra-fast last-mile delivery, offering a high-tech alternative to traditional ground shipping. → via Axios

Amazon Tests 30-Minute Delivery to Crush Instacart

Amazon has begun testing an ultra-fast service called Amazon Now, promising delivery of groceries and household essentials in 30 minutes or less. Launching in Seattle and Philadelphia with a $14 fee (or $4 for Prime members), the initiative targets the instant-needs market currently dominated by DoorDash and Instacart. → via TechCrunch

Costco Sues Trump Administration for Tariff Refunds

Costco has filed a lawsuit against the federal government seeking a refund of tariffs paid under the International Emergency Economic Powers Act. The suit anticipates a Supreme Court ruling that could declare the levies unlawful, potentially triggering a massive wave of refunds. → via Supply Chain Dive

Lower shipping costs. Stronger margins.

Walmart just expanded Ship with Walmart, giving you access to discounted carrier rates, and we’re breaking down how to turn those savings into real operational impact.

Join Yoni Mazor (Goflow) and Neil Byers (Walmart) for a walkthrough of how to streamline shipping and strengthen your Walmart performance.

📅 Dec 9 | ⏰ 1 PM EST

You’ll learn:

How Ship with Walmart secures low carrier rates

How to turn those rates into real cost savings

How Goflow unifies your shipping workflow

Bonus: Registrants unlock extra savings opportunities.

Black Friday Cyber Monday Recap: What Powered the Wins

Watch Yoni Mazor as he gives a fast breakdown of how much shoppers spent and the trends that shaped this year’s Black Friday + Cyber Monday.

Why Every Serious Ecommerce Brand Needs a Multichannel Operating System to Scale

Learn how a Multichannel Operating System (MCOS) gives operators full control across Amazon, Walmart, Shopify, and more. See how Goflow unifies listings, inventory, and fulfillment so your business can scale without chaos.

Source: People Magazine

TikTok Usage Surges to 37%, Driven by Gen Z

While YouTube leads overall, TikTok usage has climbed to 37% of U.S. adults, confirming it as the critical growth channel for reaching younger demographics. For brands targeting Gen Z, TikTok is no longer experimental—it's foundational. → via Pew Research

YouTube Is the Biggest Social Channel

A new Pew Research study shows YouTube (84%) and Facebook (71%) remain the dominant social platforms for U.S. adults. Despite the rise of new challengers, YouTube's stranglehold on attention makes it an indispensable channel for brand visibility. → via Pew Research

Gen Z Loves Black Friday, But Spends 23% Less

Black Friday isn't dead for the youth, but it is cheaper. While 40% of Gen Z planned to shop on the holiday, their overall spending is projected to be down 23%. They are showing up, but they are hunting for value more aggressively than ever. → via CNBC

Elon Musk Says "Work Will Be Optional" in 20 Years

Elon Musk is predicting that advances in AI and robotics will make human labor "optional" within the next two decades. While it sounds like sci-fi, the rapid deployment of agentic AI in retail—from Google's checkout agents to Amazon's automated fulfillment—suggests the shift is already underway. → via Forbes